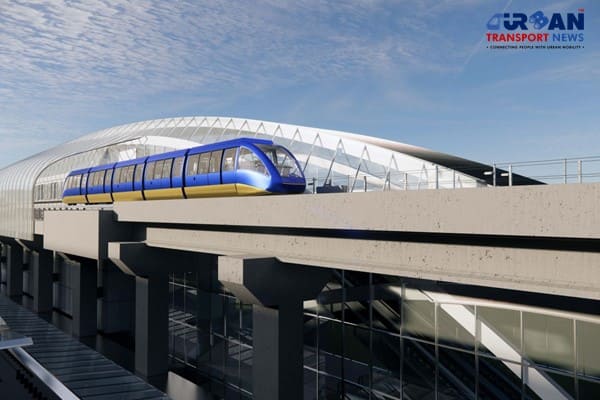

North-South Commuter Railway (NSCR): Modern Train Network Connecting Luzon Island

North-South Commuter Railway (NSCR): Modern Train Network Connecting Luzon Island India launched Bharat Taxi Service as First Cooperative-Owned Digital Mobility Platform

India launched Bharat Taxi Service as First Cooperative-Owned Digital Mobility Platform India places World’s First Live Commercial Order for Hyperloop-Based Cargo Logistics

India places World’s First Live Commercial Order for Hyperloop-Based Cargo Logistics How Weigh-in-Motion Systems Are Revolutionizing Freight Safety

How Weigh-in-Motion Systems Are Revolutionizing Freight Safety Women Powering India’s Electric Mobility Revolution

Women Powering India’s Electric Mobility Revolution Rail Chamber Launched to Strengthen India’s Global Railway Leadership

Rail Chamber Launched to Strengthen India’s Global Railway Leadership Wage and Hour Enforcement Under the Massachusetts Wage Act and Connecticut Labor Standards

Wage and Hour Enforcement Under the Massachusetts Wage Act and Connecticut Labor Standards MRT‑7: Manila’s Northern Metro Lifeline on the Horizon

MRT‑7: Manila’s Northern Metro Lifeline on the Horizon Delhi unveils ambitious Urban Mobility Vision: Luxury Metro Coaches, New Tunnels and Pod Taxi

Delhi unveils ambitious Urban Mobility Vision: Luxury Metro Coaches, New Tunnels and Pod Taxi Qatar approves Saudi Rail Link Agreement, Accelerating Gulf Railway Vision 2030

Qatar approves Saudi Rail Link Agreement, Accelerating Gulf Railway Vision 2030

Zoomcar CEO Greg Moran discusses Tesla's potential strategy shift in the EV Industry

The global automotive landscape is undergoing a profound transformation, with electric vehicles (EVs) emerging as a pivotal force driving change. In this dynamic environment, the strategies and decisions of industry leaders like Tesla reverberate across the entire EV ecosystem. Urban Transport News recently engaged in an illuminating email interview with Greg Moran, the CEO of Zoomcar, the world's largest emerging market-focused peer-to-peer car-sharing company. Moran shares insights into Tesla's potential shift in strategy within the EV space and discusses the broader implications of these developments for the industry.

As the demand for sustainable transportation solutions intensifies, especially in emerging markets, the role of EVs becomes increasingly prominent. Greg Moran believes that these markets hold immense potential for the adoption of EVs, but success hinges on learning crucial lessons from both the triumphs and setbacks witnessed in mature markets like the United States. With Zoomcar's expertise in peer-to-peer car sharing and Moran's strategic vision, the interview promises to offer valuable perspectives on the evolving landscape of urban mobility and the pivotal role of EVs within it.

What are your initial thoughts on Tesla's recent layoffs, particularly in the Supercharger division? How do you interpret this move in the context of Tesla's broader strategy in the EV space?

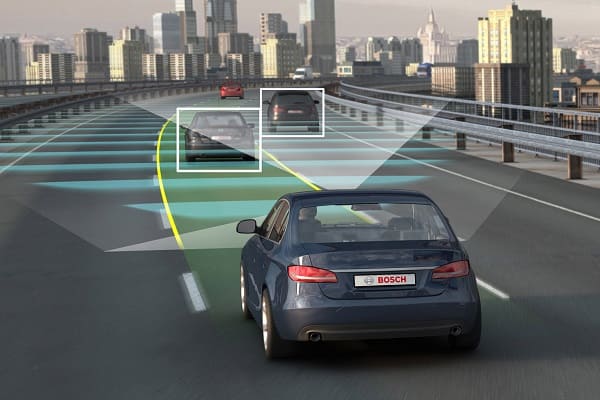

In my perspective, Tesla's recent layoffs, especially within the Supercharger division, reflect a significant strategic realignment aimed at enhancing operational efficiency and optimizing return on investment (ROI) amidst a landscape marked by intense scrutiny on capital expenditure. This move underscores Tesla's transition towards a more software-centric approach, with a heightened focus on advanced technologies such as artificial intelligence (AI) and autonomy. It's evident that Tesla is strategically reallocating resources towards initiatives with higher potential for long-term growth and profitability, particularly in the realm of AI infrastructure and autonomous driving capabilities.

Because of that, it appears that Tesla is undertaking a significant reordering to ensure that margins are preserved during this interim transition period. I expect that its restructuring aims to better position Tesla for a larger-scale outcome, transforming the company into a more agile and adaptable entity resembling a software infrastructure and robotics company. Beyond mere cost-cutting measures, this reorganization signifies Tesla's broader vision of evolving into a software and robotics company, rather than adhering to traditional automotive OEM paradigms. Historically, we've seen the dialogue around this issue miss the broader strategic context, as the layoffs are very likely just one aspect of Tesla's multifaceted evolution strategy.

As the CEO of Zoomcar, what do you see as the potential implications of Tesla's shifting strategy for the wider EV industry, especially in emerging markets?

Tesla's strategic maneuvers are poised to exert considerable influence on the broader landscape of the electric vehicle (EV) industry, particularly in burgeoning markets like China. I anticipate that other key players will likely follow suit, aligning their strategies more closely with Tesla's trajectory. I expect this trend to gather momentum, especially in anticipation of Tesla's upcoming robo-taxi reveal. However, it's essential to recognize that the impact may unfold at a different pace in emerging markets such as India, Southeast Asia, Sub-Saharan Africa, and Latin America. These regions exhibit unique consumer perspectives and varied levels of EV penetration, with foundational EV infrastructure still developing. Because of that, the transition towards EVs and autonomy may experience a delay of a couple of years compared to more mature markets. The evolution of EV ecosystems in these regions is contingent upon the establishment of robust EV infrastructure and supportive regulatory frameworks, which may necessitate additional time. With that said, while Tesla's strategic shifts are likely to shape the future of the wider EV industry, their implications may manifest differently across diverse geographical and consumer contexts.

Zoomcar operates in diverse markets globally. How do you assess the readiness of emerging markets for the transition to electric vehicles, and what unique challenges and opportunities do they present?

In assessing the readiness of emerging markets for the transition to electric vehicles (EVs), it's crucial to recognize the prevailing modes of transport and their relative prioritization. In these high-growth regions, such as India, Indonesia, Egypt, and across Africa and Latin America, the adoption of EVs is inherently tied to the predominant usage of two-wheelers, three-wheelers, and buses. While cars remain prominent in absolute terms, their penetration and usage lag behind other modes of transport.

This prioritization of alternative modes of transportation stems from the unique dynamics of these markets, where mass adoption and usage levels play a central role in shaping transportation ecosystems. As a result, the transition towards electric cars in these regions is anticipated to operate on a delayed timeline, trailing behind more mature markets like Europe, the US, and China by approximately five to six years.

Moreover, the comparative ease of scaling and lower capital expenditure associated with two-wheelers and three-wheelers make them more conducive to mass adoption. These vehicles offer a compelling avenue for job creation and supply chain development, further bolstering their appeal in emerging markets.

What lessons can be learned from the successes and failures observed in the US EV market, and how can these insights inform the strategies of companies like Zoomcar operating in emerging markets?

In reflecting on the successes and failures observed in the US EV market, it's crucial to underscore the importance of rigorous assessment and strategic clarity in resource allocation. A meticulous evaluation of every dollar invested, whether in capital expenditure or research and development, is essential for companies operating in emerging markets. EV companies entering the space need a robust ROI efficacy framework encompassing near-term, medium-term, and long-term perspectives across hardware, software, and product ownership levels.

We’ve learned some critical lessons from the hype cycles we’ve witnessed in various technology sectors, and I would caution against overestimating the intrinsic value of a product trend or wave without establishing a robust business model and identifying customer pain points you’re looking to solve. For instance, while there's often an intangible allure associated with EVs, grounded business sustainability and customer-centric considerations must take precedence before jumping into what is actually a very competitive fray. The misalignment between inflated perceptions and tangible outcomes can lead to a disconnect between product offerings and market demand, which jeopardizes long-term profitability and viability.

Historical trends have shown us that achieving product-market fit is imperative as it relates to financial performance. Companies must recognize the need for targeted investments informed by a nuanced understanding of market dynamics and consumer preferences. In other words, you can’t just adopt a blind “build it and they will come” mentality.

By prioritizing pragmatism over speculative fervor and aligning investments with tangible ROI objectives, companies can navigate the complexities of emerging markets and position themselves for sustainable growth in the evolving landscape of electric mobility.

Zoomcar has been actively involved in promoting sustainable mobility solutions. How do you envision the role of peer-to-peer car sharing in accelerating the adoption of electric vehicles, particularly in markets where traditional car ownership models prevail?

Peer-to-peer car-sharing platforms like Zoomcar wield considerable potential as drivers of incremental economic benefits within the realm of electric mobility. The inherent efficiency and lower operating costs of electric vehicles position them as ideal candidates for shared mobility solutions. By maximizing utilization rates and enhancing cost efficiencies, these kinds of platforms enable vehicle owners to derive increased revenue and profitability from their assets. This symbiotic relationship between EVs and car-sharing platforms not only drives economic benefits for vehicle owners but also contributes to the wider adoption of sustainable mobility solutions.

With the growing emphasis on sustainability and environmental concerns, how do you anticipate consumer preferences evolving in the coming years regarding electric vehicles and shared mobility services?

As EVs and shared mobility services become more mainstream, consumer preferences are poised to evolve beyond solely the environmental message, and I expect the message to evolve into a broader narrative emphasizing comprehensive value and economic benefits.

Similar shifts have been observed in other sustainable energy sectors, such as wind and solar power. While these technologies were initially embraced for their environmental benefits, today, discussions often emphasize their economic viability and cost-effectiveness compared to traditional energy sources like gas or coal. As continuous innovation in battery technology and infrastructure advancements enhance the economic feasibility of EVs, we can anticipate a similar narrative shift over the next five years. The focus will likely transition from solely environmental concerns to a more balanced consideration of both environmental and economic value propositions. While this transition may not be immediate, it's a trend that's steadily gaining momentum, and I expect it to become more pronounced by the end of the decade.